| Company: | Allied Nevada Gold Corp. |

| Ticker Symbol: | NYSE MKT:ANV; TSX:ANV |

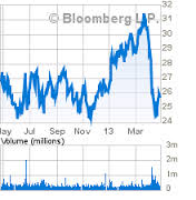

| Class Period: | Jan-18-13 to Aug-5-13 |

| Date Filed: | Apr-3-14 |

| Lead Plaintiff Deadline: | Jun-2-14 |

| Court: | District of Nevada |

| Allegations: | |

The complaint charges Allied Nevada and certain of its officers and directors with violations of the Securities Exchange Act of 1934. Allied Nevada is a U.S.-based gold mining and exploration company focused on mining, development and exploring properties throughout the State of Nevada.

The complaint alleges that during the Class Period, defendants issued materially false and misleading statements regarding the Company's financial performance and future prospects and failed to disclose adverse facts, including: (a) that one of its three impermeable leach pads, the Lewis leach pad, was beset with undisclosed operating defects and production deficiencies, including, but not limited to, an insufficient supply of fresh water to leach ore and an inadequate solution pumping and piping infrastructure; (b) that in order to remediate the operating defects and production deficiencies at the Lewis leach pad, the Company would need to double the amount of fresh water available at the facility, replace the existing irrigation tubing, piping and pumping infrastructure and seek various regulatory approvals; (c) that the recurring operating defects and production deficiencies at the Lewis leach pad were having a materially adverse effect on the Company's production costs and operating cash flows; (d) that the Company's operations were not generating the cash flow necessary to proceed with the construction of the Hycroft Mine mill; (e) that the costs to remediate the operating defects and production deficiencies at the Lewis leach pad were reasonably likely to have a material adverse effect on the Company's future production, production costs and cash flows; (f) that, while Allied Nevada's newly installed carbon columns increased its solution processing capacity, silver recovery from that process was approximately one-third of the Company's historical recovery rate; (g) that the Company's disclosure controls, and the certifications regarding those disclosure controls, were materially false and misleading; and (h) that, based on the foregoing, defendants lacked a reasonable basis for their positive statements about Allied Nevada's leach pad solutions processing capacity, the Hycroft Mine mill expansion, and the Company's expected gold and silver production and its expected operating income and cash flows.

According to the complaint, in August 2013, approximately seven months after the beginning of the Class Period, defendants shocked the market when they revealed that the Company's production costs had soared, and would continue to do so, because of systemic operating defects at the Lewis leach pad. Defendants revealed that the Company would have to double the amount of fresh water available at the Lewis leach pad and replace the existing irrigation tubing, piping and pumping or infrastructure to remedy the defects and production deficiencies, as well as obtain various regulatory approvals to undertake these corrective actions.

In addition, defendants stated that the Company would indefinitely suspend its planned expansion at the Hycroft Mine due to the Company's inability to generate sufficient cash flows from operations, which was the result of amassed ore going unprocessed at the defective Lewis leach pad. In response to these revelations, the price of Allied Nevada common stock plummeted over a two day period from $5.90 per share at the close of trading on August 5, 2013 to $3.73 per share on August 7, 2013, representing a drop of more than 40%, on unusually heavy trading volume. Just weeks prior to these adverse revelations, however, the Company sold $150.5 million shares in a secondary public offering at artificially inflated prices.

If you acquired the securities of the defendants during the Class Period you may, no later than the Lead Plaintiff Deadline shown above, request that the Court appoint you as lead plaintiff through counsel of your choice. You may also choose to remain an absent class member. A lead plaintiff must meet certain requirements.