Top Class Actions

Top Class Actions

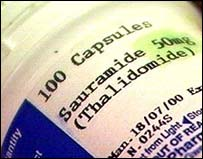

Could this mean resolution for thalidomide victims?…New research suggests that thalidomide—a drug that caused thousands of horrific cases of deformities in children—caused far more deformities in the U.S. than were reported during the height of the pharmaceutical crisis of the early 1960s.

Invented by German drug company Grunenthal, thalidomide was widely used throughout Europe during the late 1950s and early 1960s, resulting in thousands of deaths and extreme, disfiguring birth defects when used by women during pregnancy. The drug was never approved in the United States, but the new lawsuit filed late October 2011 alleges that as many as 2.5 million doses of the drug were distributed by more than 1,200 doctors to more than 20,000 people, including pregnant women.

Newly discovered and translated documents reveal that Smith, Kline and French (SKF), now owned by GlaxoSmithKline (GSK)conducted a trial of the drug in 1956 and 1957, but buried the evidence, allegedly resulting in a missed opportunity to save thousands of lives.

Instead, according to the filed lawsuit, brought on behalf of 13 men and women with severe birth defects, SKF concealed the results of its trial from the public, allowing another company, Richardson-Merrell, now owned by Sanofi-Aventis to move ahead with large-scale “clinical trials” that involved more than 20,000 people, including pregnant women.

The lawsuit also claims that conclusions made in the early 1960s about the types of birth defects caused by the thalidomide were incorrect.

According to legal counsel, researchers concluded that thalidomide causes bilateral birth defects, such as two missing or shortened arms or hearing loss in both ears. As a result, babies born with unilateral defects, such as one deformed limb, or hearing loss in only one ear were not deemed thalidomide victims, even when their mothers were given the drug while pregnant.

However, new research involving thalidomide as part of a treatment regimen in cancer patients show that many of the assumptions used in the 1960s are incorrect. The thalidomide lawsuit alleges that this new understanding of the drug means that many individuals who experienced unilateral defects may have been misdiagnosed when their doctors told them thalidomide could not have been the cause.

“Among other things we intend to show in court that thalidomide does not work through a neural mechanism as previously thought, but affects the vascular system,” a lawyer for the plaintiffs said.

The complaint claims that the defendants are either guilty of or liable for a civil conspiracy, failing to report and covering up evidence that thalidomide was harmful, especially when taken during the early stages of pregnancy. The lawsuit also says that the defendants were negligent in continuing to manufacture, test and distribute the drug.

Top Settlements

Motrin SJS Verdict. This is one for the books. Let’s hope it makes a difference. On October 3, 2011, a Los Angeles jury returned a record-setting verdict against Johnson & Johnson and their fully owned subsidiary McNeil Consumer Healthcare for $48.2 million—with pre-interest and cost of judgment it’s expected to reach $60 million. The lawsuit alleged that Motrin caused SJS/TENS or Stevens Johnson Syndrome (SJS), also known as Erythema Multiforme, Leyll’s Syndrome, and in its later stages, Toxic Epidermal Necrolysis (TEN). SJS/TEN is a serious and potentially life-threatening disease that causes large areas of the skin to become detached and lesions to develop in the mucous membranes.

The verdict was based on findings of malice towards the consumers of the over-the-counter drug Motrin, specifically for not putting a warning label on the product that could have spared Trejo’s and others’ health. This is believed to be the first verdict of its kind involving punitive damages associated with this over-the-counter temporary pain reliever.

At age 16, Christopher Trejo, who is now 22 years old, took some Motrin as directed on the label for less than one week, but contracted TEN. It caused a severe inside-out exfoliating reaction affecting all of his mucosal membranes, which is equivalent to second- and third-degree burns over 100% of his body. The TEN reaction also caused severe pulmonary damage, near-blindness, infertility, whole-body scarring and a hypoxic brain injury. Trejo’s abilities to see, hear, smell, taste and touch have been severely diminished.

After hearing the evidence, the jury found that the labeling on Motrin was inadequate and should have been changed years earlier to properly educate and alert consumers to the developing signs of severe reactions, which include skin reddening, rash and blisters. Early detection and treatment of these symptoms can prevent TEN or SJS.

Apple Playing the Same Old tune? Apple, Inc., has agreed to settle a consumer fraud class action lawsuit that could amount to over $50 million dollars in payouts—but before you get all excited know this “Apple has agreed to provide an iTunes® Store credit in the amount of $3.25 to all settlement class members who qualify and submit a valid claim form. ” That’s the skinny.

The lawsuit claimed that Apple advertised and sold gift cards which stated that if one purchased and used the gift card, all songs purchased at Apple’s online iTunes® Store would cost 99¢ per song. The lawsuit further claimed that in April, 2009, Apple raised the price of certain songs at the iTunes® store, yet refused to honor the promised 99¢ price when the gift cards were redeemed. In addition, the company continued to sell iTunes® gift cards with the phrase, “Songs are 99¢” printed on them.

Consumers who were overcharged for iTunes songs while using iTunes® 99¢ gift cards are now eligible to receive an iTunes® Store credit in the amount of $3.25 after completing the simple iTunes® class action lawsuit online claim form. Millions of e-mails are currently being sent to persons who may have used affected gift cards to purchase songs from the iTunes® Store.

You can find out how to make an Apple iTunes lawsuit claim here.

Ok—That’s enough for this week. See you at the bar—don’t forget your iPod.