Top Class Actions

Top Class Actions

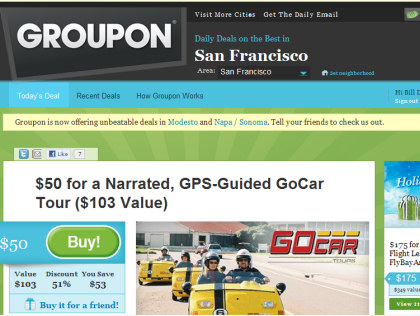

Oh those Groupon coupons—you know—the notice you find in your email every morning offering amazing deals on everything from restaurant meals to hotel stays to my personal favorite—half price pedicures… but are they too good to be true? Some people seem to think so, in fact they believe Groupon Inc. is violating Illinois state and federal laws that prohibit companies from selling gift certificates with expiration dates. So, they have filed a federal class action lawsuit against the Chicago-based business this week.

The suit was filed in the state of Minnesota on behalf of a Washington man who claims he bought a $20 Groupon for a one-month gym membership worth $305, only to have it expire before he could redeem it two months later. Umm…sound familiar?

Not surprisingly, the suit alleges that Groupon and its retail partners reap a substantial windfall from the sale of gift certificates that are not redeemed before expiration. The suit claims that Groupon “preys on unsuspecting consumers” by requiring users to agree to “boilerplate” terms and conditions that include a class action waiver. A class action waiver? Well, that certainly was effective.

Top Settlements

Credit Suisse Ponies Up for Subprime Mortgage Exposure…Credit Suisse Group AG agreed to pony-up $70 million this week, to end securities litigation over allegations that it ‘mislead investors about its subprime exposure and ability to limit losses.’ (My question, is there any financial institution out there that didn’t mislead the public over subprime mortgage exposure?)

The settlement requires court approval, but if approved it will allow recovery for investors who bought Credit Suisse’s American depositary shares, and U.S. investors who bought Credit Suisse securities in Switzerland, between February 15, 2007 and April 14, 2008.

According to reports by Reuters, on February 19, 2008, Credit Suisse took a $2.85 billion write down and suspended some traders who overstated the value of some assets. Company shares fell 6.6 percent that day. Then on March 20, Credit Suisse said write downs would contribute to a surprise first-quarter loss, and its shares fell 6.4 percent. Surprise? I think the real surprise was getting caught.

This is an extraordinary happy Friday story! This week, Midland Funding LLS agreed to drop over 10,000 debt collection cases, totally some $10.2 million in debt that it currently holds against consumers in the state of Maryland. The agreement was approved by a judge this week. The suit was filed against Midland in 2009 by consumers in Maryland.

Bit of back story—Midland is a subsidiary of the publicly traded Encore Capital Group, which buys and collects consumer debt. The case alleges that Midland “prolonged, illegal, and systematic abuse of thousands of Maryland residents.” Plaintiffs further alleged that Midland was operating as a debt collector without a state license, in violation of state and federal law. Oops. That may explain the sudden bout of corporate good will.

As part of the settlement Midland also agreed not to refile lawsuits or to sell the accounts in which there are outstanding debts. However, Midland will be allowed to contact debtors for payment as long as it follows debt-collection laws. Oh yes—Midland is now licensed to collect debts. Convenient.

Okee dokee—that’s it for this week. See you at the bar.