Top Class Action Lawsuits

Healthcare workers file overtime pay class action. Top of the list this week—one of the regulars—overtime, wage and hour violations—yes that old chestnut—again. This one’s a nationwide employment class action lawsuit filed against one the nation’s largest home health care service providers. Filed in the U.S. District Court for the District of Connecticut, the lawsuit asserts that Amedisys, Inc. (“Amedisys”) violates the Fair Labor Standards Act (FLSA).

The class action lawsuit, entitled Cook, et al. v. Amedisys, Inc., asserts that Amedisys, which has more than 16,000 employees, treats visiting nurses and other home health care providers as exempt from the overtime requirements of the FLSA and refuses to pay these employees for all hours worked or time-and-a-half for hours worked over 40 per week. Amedisys pays nurses and other health care providers on a “per visit” basis for some work, with visit rates set based on estimated average visit durations, an hourly rate for other work, and fails to pay anything at all for other hours worked. Plaintiffs allege this compensation scheme does not meet the requirements of state or federal wage and hour law.

The national lawsuit, if certified, would allow all current and former Amedisys registered nurses, physical therapists, occupational therapists, and speech language pathologists who have not been paid for all hours worked to be eligible to participate in this legal action.

Top Settlements

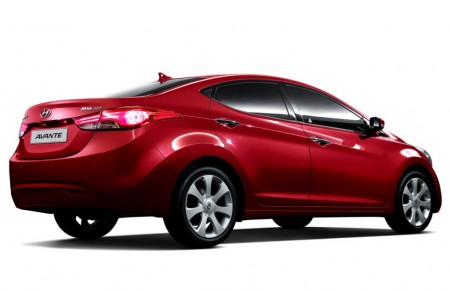

Did you rent a car from a major car rental agency with a pick-up at a California airport? If so—head’s-up—you may be entitled to part of this settlement: A settlement has been reached in an antitrust class action lawsuit filed against nine major rental car companies over allegations they improperly charged certain fees to consumers who picked up their rental cars at a California airport in 2007.

The lawsuit, entitled Shames v. The Hertz Corporation, alleges the Defendants violated antitrust and other laws by raising rental car prices at California airports by conspiring with each other to pass on the Airport Concession Fee (ACF) and Tourism Commission Assessment (TCA) to customers for rentals at certain California airport locations.

Bottom line for the car rental settlement —if you rented a vehicle directly from corporate-owned locations of Alamo, Avis, Budget, Dollar, Enterprise, Fox Rent a Car, Hertz, National or Thrifty for pick up at a California airport location from January 1, 2007 through November 14, 2007, and were charged and paid an ACF and/or TCA as a separate line item on their invoice, you may be entitled to benefits under a class action settlement.

If you are entitled to benefits under this settlement, you can elect to receive one of the options below based on the total number of days you rented one or more vehicles:

$2 for each day the vehicles were rented ($5 minimum payment); or

If the vehicles were rented for less than 8 days, one voucher good for free time and mileage for one rental day; or

If the vehicles were rented for 8 or more days, either two vouchers good for free time and mileage for one rental day; or one voucher good for free time and mileage for two rental days.

To download forms or find more information on the settlement visit acftcasettlement.com .

Negligence with staggering consequences. And now they’re going to pay for it. A $122.5 million settlement has been reached in an environmental lawsuit brought against Sierra Pacific Industries by the United States Department of Justice. The lawsuit was filed over a 2007 wildfire that was among the most devastating in California history, according to the Department of Justice.

The fire, known as the Moonlight Fire, effectively destroyed 65,000 acres, 46,000 acres of which were national forests. Further, the fire killed more than 15 million trees on public land, some of which were more than 400 years old. It also destroyed thousands of acres inhabited by sensitive species including the California spotted owl, the Sacramento Bee reports. “The Moonlight Fire was a devastating blow to National Forest land here in California,” U.S. Attorney for the Eastern District of California Benjamin B. Wagner said in a statement. “What was lost was priceless and will not return for over a century.”

The fire was caused by Sierra Pacific employees and a contractor who struck a rock with a bulldozer, according to government prosecutors. This sent sparks into the dry ground on a day the National Weather Service had issued a red flag warning, indicating a high fire danger. The smoldering fire went unnoticed because the employees skipped a company-required fire patrol, prosecutors said.

“Instead, the designated fire watch left the work area and drove 30 minutes away to get a soda. When he returned over an hour later, there was a 100-foot wall of smoke billowing from the work area,” the Department of Justice said in a statement. Yes – sadly – that is what happened. Incredible.

The Moonlight Fire settlement is the largest ever received by the United States for damages caused by a wildfire. It includes a $55 million cash payment and 22,500 acres of land in California owned by Sierra Pacific. The U.S. Forest Service will choose the land, which prosecutors said is expected to bridge gaps between existing national forests and will support critical watersheds and sensitive species habitats.

Ok—That’s a wrap. Happy Friday! See you at the bar!