Top Class Action Lawsuits

Top Class Action Lawsuits

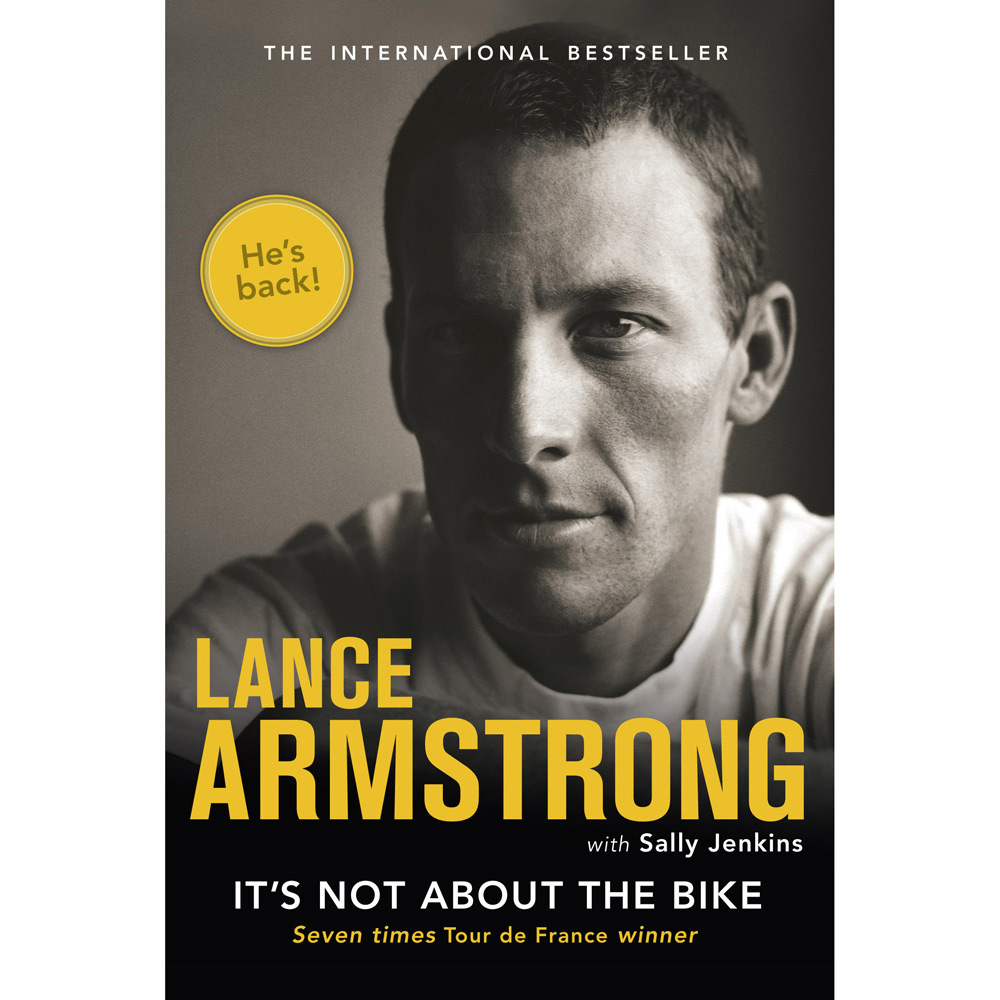

File Under “Fiction”. You would pretty much have to be living on the dark side of the moon not to have heard of the consumer fraud class action lawsuit filed against the publishers of Lance Armstrong’s book “It’s Not About the Bike.” Indeed it’s not.

Filed following the interview/confession with Oprah Winfrey earlier this week, the lawsuit alleges the publishers sold Lance Armstrong’s latest book as fact, when it was fiction. Quelle Surprise!

And, the lawsuit, filed this week in federal court in California, also mentions Armstrong’s other book, “Every Second Counts,” and accuses the cyclist and his publishers of fraud and false advertising.

The lawsuit, filed by Rob Stutzman in federal court in California, also mentions Armstrong’s other book “Every Second Counts, and alleges Armstrong and his publishers are guilty of consumer fraud. Specifically, the lawsuit states “At that time, Stutzman thanked Defandant Armstrong for writing his book and told him it was very inspiring and that he recommended it to friends who were fighting cancer.” Stutzman contends that had he and others similarly situated known Armstrong’s accounts were lies, they would not have purchased the book, or have enjoyed it less.

“Throughout the book, Defendant Armstrong repeatedly denies that he ever used banned substances before or during his professional cycling career,” the lawsuit states. The lawsuit also states that the plaintiffs purchased the book “based upon the false belief that they were true and honest works of nonfiction when, in fact, Defendants knew or should have known that these books were works of fiction.” Well, everyone likes a good story, and this is certainly no exception.

Is Subway selling a Whopper? …instead of a Footlong? We’ll have to wait and see… A consumer fraud class action lawsuit was filed this week against the sandwich chain Subway, alleging it advertises the $5 Footlong sandwiches when they are not a foot long.

The Subway Footlong lawsuit, Pendrak & Farley v. Subway Sandwich Shops Inc., et al., Superior Court for the State of New Jersey, claims the famous sandwiches actually measure between 11-11.5 inches, instead of 12 inches as advertised. (no comment).

The lawsuit further claims that Subway is aware its Footlong sub sandwich is not 12 inches, because sandwich prices are set at the corporate level then sent down the line to the individual franchises. Consequently, Subway is purposefully defrauding its customers by selling so-called “$5 Footlongs,” according to the lawsuit.

Top Settlements

This round’s on Southwest! Yes, indeed—Southwest Airlines reached a tentative settlement of a pending class action lawsuit over drink vouchers. Included in this Settlement are Southwest customers who received a drink coupon with the purchase of a Business Select ticket prior to August 1, 2010, and did not redeem the drink coupon.

Filed in 2011, Southwest Airlines class action lawsuit plaintiffs, Adam Levitt (an attorney himself) and Herbert Malone, alleged the airline’s policy changes around its drink vouchers, which became effective after August 1, 2010, amounted to a breach of contract and made the coupons worthless. The policy change stipulated that while the drink vouchers had no expiration date, they could only be used on the dates voucher holders were traveling. The vouchers were issued to passengers for alcoholic drinks.

Southwest Airlines drinks vouchers changes were brought in because, the airline claimed, passengers were photocopying them to get free drinks.

The settlement includes Business Select passengers who were issued vouchers before August 1, 2010. Based on Southwest’s charges of $5 per alcoholic drink, the settlement may cost the airline as much as $29 million, with some 5.8 million vouchers up for redemption. The final fairness hearing is set for May, 2013.

The proposed settlement includes damages for Class Members who received Southwest drink coupons through the purchase of a Business Select ticket prior to August 1, 2010, but did not redeem those drink coupons for a free drink. Eligible class members must file a claim before September 2, 2013.

So—see you at the bar—and don’t forget your voucher!