Top Class Action Lawsuits

Top Class Action Lawsuits

Paycheck Rounding Error? Seems unpaid overtime is a popular theme these days. This week, a new unpaid overtime class action lawsuit was filed in the City of St. Louis on behalf of current and former nurses and medical professionals employed by BJC Healthcare System for violations of Missouri’s wage and hour laws and other violations of Missouri law. The lawsuit seeks unpaid overtime and straight-time wages resulting from BJC’s wage and hour practices. The lawsuit is entitled Speraneo v. BJC Health System Inc., d/b/a BJC Healthcare.

The BJC class action lawsuit alleges that BJC failed to properly pay employees for all time worked through its time recording policies and failed to pay overtime compensation to employees working over forty hours per week.

BJC’s timekeeping rounds down the amount of time employees work to the nearest quarter hour, despite having the exact times employees clocked into work and having computerized documentation of exact work times. This practice deprived employees of pay for compensable work time in violation of established work time regulations.

BJC automatically deducts time for meal breaks resulting in employees, such as nurses, not being paid for time actually worked. The lawsuit alleges that BJC knew that its employees, such as nurses, worked during the automatically deducted break time and as a custom and practice failed to pay employees for such compensable work.

The lawsuit also alleges that BJC failed to properly compensate employees for shift differential bonuses and pay overtime compensation at statutorily required rates of pay.

Top Settlements

A sweet ending for Hershey employees? Seems that way—if a preliminary $500,000 settlement gets the green light. The preliminary settlement has just been approved in a California unpaid overtime and wage and hour class action lawsuit pending against Hershey.

The Hershey lawsuit alleges that the class members are owed wages including unpaid overtime and minimum wage pursuant to several sections of the California labor law and are owed premium pay for missed meal and rest periods also pursuant to various Labor Code sections. The lawsuit further claims that the class is entitled to “waiting time” penalties, and penalties for non-compliant wage statements and payroll records pursuant to various Labor Code sections, and that they are entitled to reimbursement for business expenses.

The lawsuit is brought by Shelley Rodrigues on behalf of herself and other similarly situated who were or are employed as retail sales merchandisers, as well as all other current and former hourly-paid or non-exempt merchandisers or person who held similar job titles and/or performed similar job duties in California.

The settlement class is defined as all current and former hourly part-time retail sales merchandisers employed by the Hershey Company in California at any time between July 23, 2008 and June 3, 2013, the Class Period.

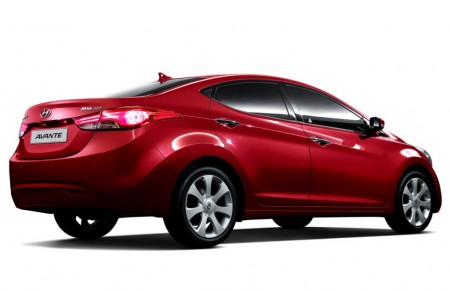

Time for Honda to Feel the Burn? This is a biggie…Honda looks as if it’s ready to pony up some cash over a defective automobile class action lawsuit pending against it. The Japanese automaker was sued over allegations it made over 1.59 million vehicles that burn oil excessively and also require frequent spark plug replacements. That’s convenient.

The Honda lawsuit, filed in March 2012, alleges the Honda vehicles had a “systematic design defect that enables oil to enter into the engine’s combustion chamber.” The alleged defect led to “premature spark plug degradation and engine malfunction,” court documents state.

The lawsuit claims that Honda was aware of the problem but failed to notify consumers, allegations Honda denies, despite having issued a technical service bulletin notifying its technicians to check for the defect. The auto maker did not issue a recall because a safety issue was not discovered.

The preliminary Honda class action settlement includes all US purchasers and lessees of 2008-12 Accord, 2008-13 Odyssey, 2009-13 Pilot, 2010-11 Accord Crosstour and 2012 Crosstour vehicles equipped with six-cylinder engines that have variable cylinder management. Accord vehicles with four-cylinder engines are not included in the settlement.

Settlement terms include Honda extending the powertrain limited warranty for up to eight years after the original sale or lease of the vehicle. The preliminary settlement approval was given October 9, 2013, and the final fairness hearing is scheduled for March 21, 2014.

Ok Folks, That’s all for this week. Have a good one—see you at the bar!