Top Class Action Lawsuits

Top Class Action Lawsuits

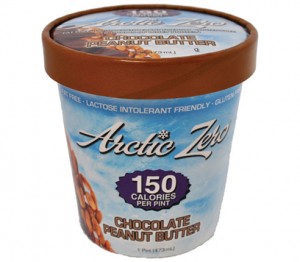

Zero Truth? Before you take what you think may be a harmless mouthful of melt-in-your-mouth pleasure—namely Arctic Zero frozen desserts—WAIT—that ‘150 calorie per pint’ thing—may not be entirely accurate. At least that’s the claim in a consumer fraud class action lawsuit filed against Arctic Zero this week. The lawsuit claims the frozen desserts have 46% to 68% more calories than advertised. If this is true, it is seriously bad news for everyone.

The lawsuit, entitled Brenda Freeman v. Arctic Zero, Inc., Case No. 12-cv-2279 L BGS, US District, Southern District of California, alleges the company deceptively labels and markets its frozen treats as having only “150 calories per pint.” However, the frozen desserts contain up to 68% more calories than advertised based on findings from recent independent laboratory tests performed by EMSL Analytical, Inc. The deserts include Arctic Zero Chocolate Peanut Butter, and Arctic Zero Vanilla Maple which allegedly has 46% more calories than the 150 calories prominently advertised on the front of the product packaging as well as on its nutritional label, according to the class action lawsuit.

The Arctic Zero class action lawsuit is seeking to represent a proposed class of all U.S. persons who, since 2009, purchased any Arctic Zero frozen desserts advertised as containing 150 calories per pint or less. They’re seeking damages and restitution for Class Members as well as an injunction barring Arctic Zero from continuing to falsely advertise the calorie content of their products.

Top Settlements

Payless to PayMore? Payless shoes looks set to pay more to settle fraudulent advertising claims for its Champion toning shoes. A proposed settlement (the “Settlement Agreement”) has been reached in the consumer fraud class action lawsuit against Payless ShoeSource, Inc. (“Payless” or “Defendant”). The Payless toning shoe lawsuit has been brought on behalf of a nationwide class of persons who purchased any Champion-branded style of toning shoes.

The lawsuit alleges that Payless engaged in untrue and deceptive advertising promotion and marketing practices associated with its Champion-brand toning shoes. You may be a member of the Settlement Class and might be eligible to receive a merchandise certificate worth $8.00 if you are a person who purchased any Champion-branded toning shoes during the period January 21, 2006 through June 25, 2012.

If you are a Settlement Class member and the Court gives final approval to the Settlement Agreement:

- You may be entitled to receive an $8.00 merchandise certificate (a “Settlement Payment”).

- You will be giving up the right to bring certain legal claims in the future, as discussed more fully below.

To Submit a Payless Toning Shoe Settlement Claim Form

If you are a Settlement Class member and would like to receive your Settlement Payment, you must submit a Claim Form, either through the mail or by by clicking here. You will be giving up legal claims against the Defendant and other related entities. Your claim must be submitted or postmarked no later than January 5, 2013.

If you do nothing, you will not receive your Settlement Payment. You will, however, still be giving up legal claims against Defendant and other related entities.

To Exclude Yourself from the Payless Toning Shoe Settlement

You will receive no benefits, but you will not be giving up your right to sue Defendant or related entities.

If you believe you are a Settlement Class member and would like further information, go to paylesstoningshoeclassaction.com

More bang on your buck? Umm, maybe not. Hopefully not. It all depends on whether or not preliminary settlements are approved in two class actions brought against Citizens and TD Banks.

This week, a federal judge in Miami preliminary approved two settlements in the excessive overdraft fees class action lawsuits against Citizens Bank and TD Bank. If approved, Citizens and TD Banks would be the first two of 14 banks to settle their cases. The settlement agreement will see Citizens pay $137.5 million and TD $62 million. Cha ching!

The lawsuit alleged the banks charged excessive overdraft fees on checking account customers. Specifically, the banks’ internal computer system re-sequenced the actual order of its customers’ debit card and ATM transactions, by posting them in highest-to-lowest dollar amount rather than in the actual order in which they were initiated by customers and authorized by the bank. The plaintiffs alleged that this practice resulted in bank customers being charged substantially more in overdraft fees than if the debit card and ATM transactions had been posted in the order in which they were initiated and authorized.

A final hearing seeking approval of the settlements is scheduled for March 7, 2013.

Okee dokee. That’s it for this week—See you at the bar.