Top Class Action Lawsuits

Top Class Action Lawsuits

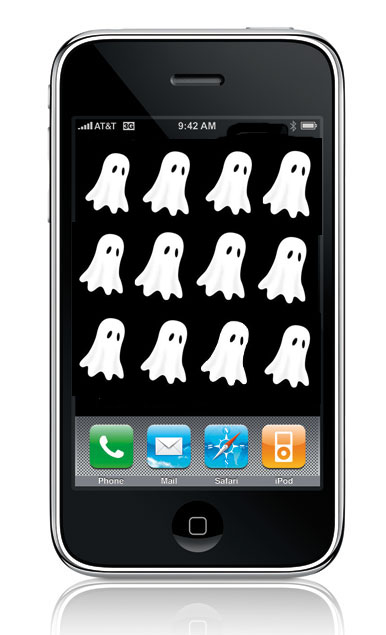

Hey Apple, iAin’t got HD. Apple is facing yet another consumer fraud class action lawsuit. This week’s lawsuit contends that the tech giant charges its iTunes customers extra for accessing high definition (HD) media products for older Apple devices, despite the fact that those devices lack HD capability.

Hmm.

In the Apple iTunes class action lawsuit, lead plaintiff Scott J. Weiselberg claims that the default download option provided on Apple’s iTunes is HD, which is more expensive than non-HD options for movie and TV show rentals, for example.

The backstory—in 2008, Apple began offering movie and video download rentals for its iPhone, iPod and iPad devices. However, early models of these devices were not equipped with HD, and so cannot run HD content, but are restricted to playing standard definition (SD) content instead. Only newer versions of Apple products are HD-capable.

The lawsuit alleges that in June 2010 Weiselberg, who owned a 3G SD iPhone, rented the movie “Big Daddy” from iTunes, paying $4.99 in rental fees. He alleges he was unaware that a cheaper option was available for rental—the SD version of the movie. Had he known, he claims, that would have been the version of the movie he would have rented. Makes sense.

Weiselberg alleges that while Apple eventually added a notice to the iTunes download notifying customers of the availability of SD, by that time Apple had already collected “millions of dollars in undeserved profits.”

The consumer fraud class action claims that Apple’s failure to notify its customers of the SD option is a violation of California’s Unfair Competition Law. He is seeking restitution, an injunction and damages for unjust enrichment. We shall see….

Top Settlements

TVM Settlement, For Some. A victory at last—for some women—but the battles go on. A $54.5 million settlement has been reached, potentially ending several transvaginal mesh lawsuits which allege the implants eroded in the plaintiffs, leaving them incontinent and suffering from chronic pain.

Endo Health Solutions Inc, which acquired American Medical Systems Inc., (AMS), the maker of the vaginal-mesh devices, which include the Perigee, Apogee and Elevate implants, said in a statement that is set to resolve an undisclosed number of the vaginal mesh personal injury lawsuits. However, AMs is facing over 5,000 such lawsuits, which have been consolidated: the first lawsuit set to go to court in December 2013. This settlement agreement doesn’t address these lawsuits.

The AMS settlement will resolve a small number of vaginal mesh injury lawsuits filed in both federal and state courts. Lawyers representing the plaintiffs stress that no universal settlement has been made. The first cases are set to go to court later this year.

In August 2011, the US Food and Drug Administration issued a report stating vaginal-mesh products should be classified as high risk devices, based on a review of side-effect reports from January 2008 to December 2010. Women’s groups are demanding that the devices be recalled. I should think so.

Better late than never! Heads up anyone who purchased or knows an elderly person who purchased Jackson National annuities—A $25 million settlement has been proposed, which, if approved, would settle the proposed consumer fraud and elder financial abuse class action pending against Jackson National Life Insurance Co. The insurer has agreed to pay the settlement which would end the litigation and bring economic relief to over 44,000 elderly customers in California who bought their fixed deferred annuity products. Yes—44,000 customers.

The Jackson National annuities lawsuit alleges that Jackson National targeted its senior citizen customers in the selling of its deferred annuities that had hidden fees, commissions and surrender penalties, essentially defrauding these clients.

According to court documents, the terms of the proposed class action stipulate that Jackson National make cash payments or account credits equal to 22 percent of any past surrender charges the affected policyholders incurred. The insurer will also reduce any future surrender charges by 22 percent. If the Jackson National settlement is approved, these benefits will go into effect automatically; there will be no claims process, and Class Members will not be required to do anything to receive the full settlement benefit.

“The price of delay is particularly high in this litigation because a substantial portion of the class consists of elderly consumers who cannot wait years for relief,” the memorandum said. “Continuation of the litigation would be extremely expensive and risky.” To say the least— perhaps?

The proposed Class includes all California individuals who were age 60 years or older when they purchased misleading deferred annuities from Jackson National insurance, between October 24, 2002, and January 12, 2012.

Okee dokee—that’s it for this week. A safe and happy weekend to all. See you at the bar!