Top Class Action Lawsuits

Top Class Action Lawsuits

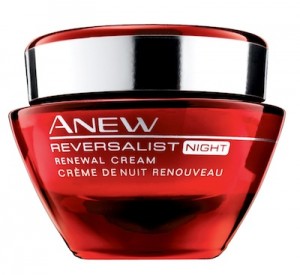

Company for Women? Not for this woman—and many others sure to be in her ‘class’. Avon Inc., the cosmetics company of door-to-door fame, is facing a potential consumer fraud class action lawsuit over anti-aging claims of its Anew skin care line. The Avon Anew class action includes such would-be miracle creams as Anew Clinical Advanced Wrinkle Corrector, Anew Reversalist Night Renewal Cream, Anew Reversalist Renewal Serum and Anew Clinical Thermafirm Face Lifting Cream products.

And the woman who’s at the lead of all this? That would be Lorena Trujillo, the lead plaintiff in the lawsuit, who alleges Avon earned “handsome profits” by misleading consumers into believing Anew anti-aging products can boost collagen production, recreate fresh skin and fortify damaged tissue, offering “at-home answers” to “procedures found in a dermatologist’s office.” Tall order, for sure, but hey—who wouldn’t want to believe it?

Earlier this month, the Food and Drug Administration (FDA) issued a warning to Avon regarding these anti-aging products, indicating that they have been misrepresented to consumers. In the warning, the FDA demanded that Avon revise certain advertising claims about the products, including the suggestion that they can change the structure or function of the body (hello, collagen production?) which would classify them as drugs under FDA regulations and require FDA approval. Therefore, Avon’s Anew anti-aging products “are not generally recognized among qualified experts as safe and effective,” the FDA said.

The Avon Anew class action lawsuit seeks to represent all U.S. consumers who purchased Anew Clinical Advanced Wrinkle Corrector, Anew Reversalist Night Renewal Cream, Anew Reversalist Renewal Serum and Anew Clinical Thermafirm Face Lifting Cream products based on Avon’s allegedly misleading advertising claims about these products.

The Lawsuit is Lorena Trujillo v. Avon Products, Inc., Case No. 12-9084, California Central District Court. Trujillo is represented by the law firm Baron & Budd.

Unpaid Overtime in Overtime Already! An overtime class action lawsuit has been filed against Maxim Healthcare Services Inc, by Jasmine Lawrence, who was employed as a Home Health Aide by the defendant until October 2012.

In the Maxim Healthcare class action lawsuit, Lawrence alleges that Maxim Healthcare Services Inc, violated, and continues to violate, the Ohio Minimum Fair Wage Standards Act (OMFWSA) because of its willful failure to compensate her and the class members at a rate not less than one and one-half times the regular rate of pay for work performed in excess of 40 hours in a workweek. Lawrence claims she regularly worked over 70 hours per week while employed by Maxim Healthcare and the majority of her time was spent performing general housekeeping duties as opposed to patient care.

Lawrence also alleges that she and the members of the putative class who are employed by the Defendant in Ohio are “employees” within the meaning of the OMFWSA.

Lawrence, the lead plaintiff in the employment class action, seeks to bring her claim for violation of the Fair labor Standards Act (FLSA) as a nation-wide collective action, and as a statewide class action based for violation of the OMFWSA.

Maxim Healthcare Services, Inc, is a Maryland corporation which, through hundreds of office locations nationwide, provides in-home personal care, management and/or treatment of a variety of conditions by nurses, therapists, medical social workers, and home health aides. Lawrence and the class are represented by Ben Stewart of Stewart Law PLLC.

Top Settlements

Time to Pay Up–Finally. LoJack agreed a class action settlement agreement this week, ending, hopefully, two California wage-and-hour class action lawsuits. The LoJack settlement, which is subject to final approval, stipulates that LoJack will pay up to $8.1 million, including plaintiffs’ attorneys’ potential fees and costs, to resolve all remaining California state class action claims.

As previously disclosed, in the related California federal wage-and-hour case, the Company paid the class action plaintiffs $115,000 in 2011 to settle the federal claims. During 2011, the Company also recorded a $1.1 million accrual with respect to plaintiffs’ attorneys’ fee application in the federal case. In early August 2012, the federal court awarded plaintiffs’ attorneys’ fees and costs of $900,518 related to those claims. Although the Company filed a notice of appeal with respect to the attorneys’ fee award in the federal case, the Company has agreed to waive that appeal as part of this settlement.

The LoJack settlement agreement involves no admission of wrongdoing, liability or violation of the law by the Company. In addition, the agreement bars the named plaintiffs in the California state class action from pursuing further claims against the Company.

The Company expects the Court to issue a decision shortly regarding preliminary approval of the proposed settlement. Should the Court grant preliminary approval, California class members would be sent a notice of the settlement and given the opportunity to decide whether to participate. LoJack could pay less than $8.1 million in settlement of the state court case depending on the level of participation by class members in the settlement. Following the notice period, the parties may move for final approval of the settlement. LoJack anticipates that the Court would be in a position to rule on final approval of the proposed settlement by the first or second quarter of 2013. LoJack does not anticipate paying any portion of the settlement of the California state case until the Court has granted final approval.

And this Round’s on Them! Morgan Keegan & Co. Inc. has agreed to pay $62 million as part of a preliminary settlement of a securities class action involving more than 10,000 nationwide clients. The Commercial Appeal has reported the terms of the settlement won’t force the investment firm to admit any wrongdoing resulting from the 2008 meltdown of its mutual funds. Of course. Accidents happen…we all know that.

The lead plaintiff in this class action lawsuit is a Texas hedge fund which claimed a $2.1 million investment in Morgan Keegan’s closed-end mutual funds.

The Morgan Keegan settlement remains to be approved by a federal judge, and if approved, will leave one more class action outstanding against the investment firm, this one related to conventional mutual funds.

And on that note—I’ll see you at the bar. Have a great weekend!