Top Class Actions

Top Class Actions

Now here’s a hairy situation—(or not…) Merck Frost and its affiliated companies are facing a Canadian class action over allegations that men who used Propecia or Proscar suffered continuing sexual dysfunction as a side effect of treatment.

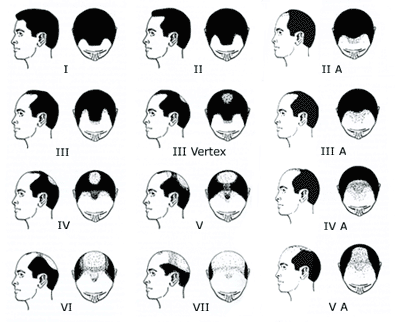

FYI—Propecia and Proscar are prescribed as a cosmetic treatment for male pattern hair loss also known as androgenic alopecia. The product monograph discloses that some men may experience sexual dysfunction but states that the symptoms disappear after cessation of the drug.

That, apparently, is not what happened in Michael Miller’s case—he’s the brave man who filed the suit.

Mr. Miller, who is in his early 20s, was concerned when his hair started to thin in some areas. Completely understandable. So he went to his doctor who presumably prescribed Proscar in the hope that it would stop his hair from thinning. After about a month of use he noticed a drastic change in his behavior, “I lost my interest in sex and I felt anxious in social situations for no particular reason,” he says. While on the drug, his symptoms of sexual dysfunction increased as the Continue reading “Week Adjourned: 2.18.11”

Top Class Actions

Top Class Actions