Top Class Action Lawsuits

Top Class Action Lawsuits

Another year, another Apple Lawsuit. Yup. This week, iPhone users in Miami filed a consumer fraud class action lawsuit against Apple Inc, alleging the Cupertino-based tech giant greatly overstated the storage capacity of devices that run its latest mobile operating system, iOS 8.

Lead plaintiffs filed the complaint in U.S. District Court in Northern California claiming operating system itself requires a significant percentage of the storage capacity on the iPhones, iPads and iPods that run it, thereby making a large portion of the advertised space unavailable to device owners.

According to the lawsuit, in some cases, the space used is 23.1 percent. Further, the complaint alleges, Apple entices customers in need of more space to pay for extra storage on iCloud.

“Using these sharp business tactics, [Apple] gives less storage capacity than advertised, only to offer to sell that capacity in a desperate moment, e.g., when a consumer is trying to record or take photos at a child or grandchild’s recital, basketball game or wedding,” the lawsuit states. “To put this in context, each gigabyte of storage Apple shortchanges its customers amounts to approximately 400-500 high resolution photographs.”

The plaintiffs allege Apple is violating California laws prohibiting unfair competition and false advertising. They claim that reasonable consumers do not expect the “marked discrepancy” between the advertised level of storage capacity and the available level of capacity on Apple devices running the OS.

GM’s Record Year? GM must be facing some kind of record for the number of defective automotive class action lawsuits filed against it in 2014. The latest GM lawsuit, filed in December, alleges a defect in the steering system of its Chevrolet Volts which causes the steering wheel to freeze intermittently while driving. Yes—that could certainly cause a few problems.

Filed in New Jersey federal court, by plaintiffs Christopher Johnson and Tara Follari-Johnson, the GM lawsuit claims that GM knew, or should have known, about the alleged defect, but continued to sell the cars. The lawsuit further claims that the alleged defect poses a hazardous safety risk to drivers and that even when GM agrees to fix the steering system, it only replaces the allegedly defective steering rack with the same or similarly defective components.

“When class members present to GM’s authorized dealerships complaining of the steering defect, the dealerships recommend repairs such as replacing the steering rack or steering gear assembly,” the plaintiffs said. “However, these repairs only temporarily mask the problem.”

The lawsuit alleges GM is in violation of the New Jersey Consumer Fraud Act and the Magnuson-Moss Warranty Act, and in breach of implied warranty of merchantability and express warranty and common law fraud.

The plaintiffs propose to represent a nationwide class of owners and lessees of 2011-2014 Chevrolet Volt bought or leased new in New Jersey and a subclass of national class members who live in New Jersey. There are at least 100 members of the proposed class, according to the plaintiffs, and their claims are more than $5 million.

“Complaints that consumers filed with National Highway Traffic Safety Administration and posted in discussion forums demonstrate that the defect is widespread and dangerous and that it manifests without warning,” the complaint states. “The complaints further indicate defendants’ knowledge of the defect and its danger.”

Top Settlements

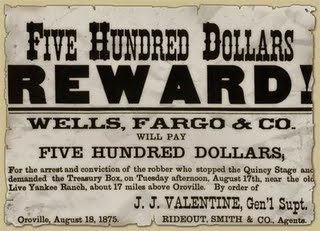

Wells Fargo Agreed to Pony Up $14.5 million as part of a preliminary settlement agreement reached in a Telephone Consumer Protection Act (TCPA) class action lawsuit. The lawsuit was brought on behalf of millions of customers who alleged Wells Fargo Bank NA called them on their cellphones to collect credit card debt.

Brought by lead plaintiff Lillian Franklin, the Wells Fargo settlement motion, if approved, will resolve her suit claiming the bank violated the Telephone Consumer Protection Act by making automated calls to alleged debtors without their consent. She filed suit in August, claiming the financial institution called her multiple times on her cellphone in 2010, to collect an alleged debt on her credit card. The calls featured a pre-recorded message and were made without Franklin’s consent, according to the lawsuit.

According to the settlement terms, a settlement fund will be shared evenly between class members who submit claims. Currently, the class consists of 4 million members. The fund will established after consideration of attorneys’ fees and administration costs, according to the motion.

The case is Franklin v. Wells Fargo Bank NA, case number 3:14-cv-02349, in the U.S. District Court for the Southern District of California.

Hokee Dokee—That’s a wrap folks…Time to adjourn for the week. Happy New Year!

The Age of the Overtime Class Action…

The Age of the Overtime Class Action… It was a big class action week on the home front…

It was a big class action week on the home front… egations that it withheld as much as $100 million in overtime wages from its account managers.

egations that it withheld as much as $100 million in overtime wages from its account managers.